adverts

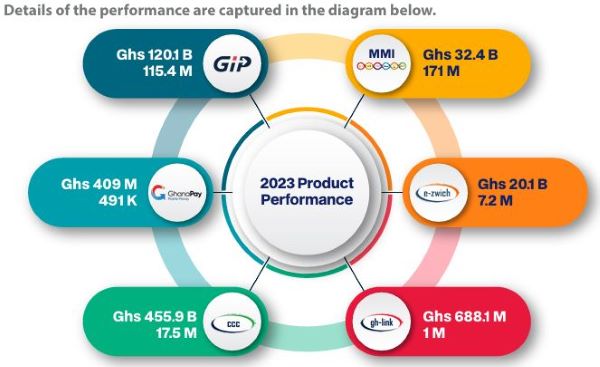

Ghana Interbank Payments and Settlements Systems (GhIPSS) recorded a total of GHS629.5 billion in transaction value from 312.9 million transaction in 2023.

This is contained in the first quarter 2024 edition of GhIPSS Update newsletter.

The breakdown would show that the instant pay services at GhIPSS, dominated by fintech activities, are becoming the main stay of the platform.

adverts

Per the report, GhIPSS Instant Pay (GIP), recorded GHS120.1 billion in 115.4 million transactions, Mobile Money Interoperability recorded GHS32.4 billion in 171 million transactions, while GhanaPay recorded GHS409 million in 491,000 transactions.

In effect, the three products account for a total of GHS152.9 billion in 286.9 million transactions. This means, it terms of volumes, the instant pay services accounted for a whopping 89% of transactions at GhIPSS, even though in terms of value, they contributed just about 24.3%.

Meanwhile, the topmost product in terms of performance for the year, was the Chearing House, which recorded a significant GHS455.9 billion in 17.5 million transactions, while gh-link card recorded an some GHS688.1 million in one million transactions, and the good old e-zwich card saw some 20.1 billion in 7.2 million transactions.

According to the report, even with the Clearing House platform, the key drivers there were the ACH Direct and the Near Real-time product, which mimic instant pay product and further deepen the assertion that instant pay has become the key driver of the GhIPSS platform.

Percentage Growth over 2022

Even more interesting is the significant levels of growth in performance between 2023 and 2023.

Figure 2 above shows that the total volume of transactions in 2023 grew by more than 30.5% over that of 2022, while volume of transaction grew by almost 37% over the period.

In terms of the breakdown, the GhanaPay recorded the highest percentage of growth by far, in both value (5,000%+), and volume (883%+), even though the it recorded the least in terms of the actuals.

Again, the figures would show that another instant pay product, GIP recorded the second highest rate of growth between 2022 and 2023, which stood at 104%+ in value and 50.84% in volume.

Mobile Money Interoperability, on the other hand, grew by over 22% in value and more than 23% in volume over the period, while e-zwich grew by almost 37% in value and over 17% in volume. Gh-link also held its own on the value side with almost 25% growth, but recorded a rather insignificant 1.4% growth in volumes over the one year period.

Chief Executive Officer of GhIPSS, Archie Hesse applauded all of GhIPSS’ partners for their role in ensuring the success and forward march of the platform, indicating that the opportunity exist for the industry to shape the financial sector of the country and he was hopeful that with their continuous support, that will be achieved.

Going forward, GhIPSS will be processing Visa Card transaction locally, thanks to a deal it signed with Visa recently. Indeed, it is also in the process of signing a similar deal with Mastercard.

The two deals will not only reduce the cost of international card transactions for banks and their customers, but also drive financial inclusion by ensuring a wider access to such cards across the country.

GhIPSS has also established an academy in its new head office build to engage and train various stakeholders on emerging industry topics.