adverts

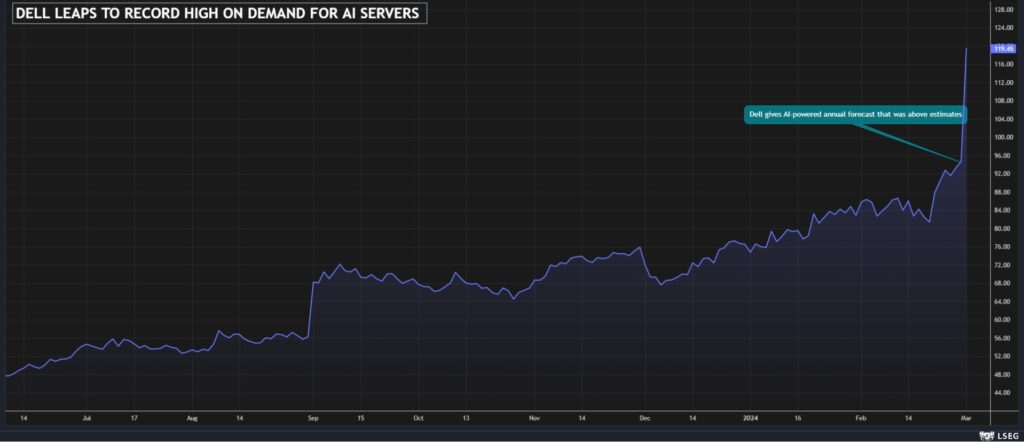

Dell Technologies shares surged 25% to hit a record high on Friday, following an upbeat annual forecast that indicated the tech equipment maker was benefiting from the AI boom.

The stock climbed to $118.8, and was set to add $17.7 billion to the company’s market value and on track to register its best intra-day performance.

The surge provides further evidence that rising AI adoption is driving gains across enterprise technology vendors, and adds to the frenzy on Wall Street following Nvidia stunning rally.

adverts

“We have positioned ourselves well in AI,” COO Jeff Clarke said on Thursday, noting that more customers were demanding PCs and servers with AI capabilities.

Orders for the company’s AI-optimized servers, including the flagship PowerEdge XE9680, jumped 40% sequentially in the fourth quarter, Clarke said.

At least nine brokerages raised their price targets on Dell after the results. Currently, over three-fourths of the analysts have a “buy” or higher rating with a median target price of $113.

More than 31 million Dell shares had changed hands as of 10:40 a.m. Eastern time, more than seven times the stock’s 30-day average trading volume.

“Dell’s AI business showed strong progress on key metrics… commentary on the PC market was similar to HP’s: that a rebound is coming, but it is being pushed out to the second half of the year,” said analysts at Bernstein.

PC and enterprise technology vendor HP’s, sales declined for a seventh straight quarter in the most recent three-month period.

The recent upside in the business comes after Dell struggled for most part of the last two years as worldwide computer sales sharply declined. While revenue fell less-than-expected in its fourth quarter, annual revenue dropped for the first time since re-listing in 2018.

Dell forecast revenue between $91 billion and $95 billion for its current fiscal year ending January 2025, largely above analysts’ average estimate of $92.07 billion.