adverts

The Institute of Economic Research and Public Policy (IERPP) has fired back at Finance Minister Dr. Cassiel Ato Forson, challenging his assertion that the Mahama administration’s borrowing is merely a buffer to service debts inherited from the previous New Patriotic Party (NPP) government.

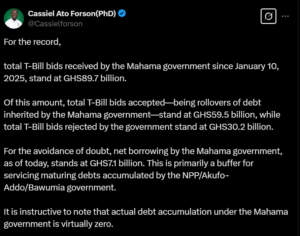

Dr. Forson, in a recent post on X (formerly Twitter), insisted that the government’s net borrowing stands at GHS7.1 billion, emphasizing that most of the funds raised were used to roll over existing debts rather than accumulate new ones.

adverts

The Finance Minister claimed that since January 10, 2025, total Treasury bill bids received by the Mahama administration amounted to GHS89.7 billion, out of which:

- GHS59.5 billion was accepted as rollovers of existing debt,

- GHS30.2 billion was rejected, and

- The actual net borrowing by the government stood at GHS7.1 billion.

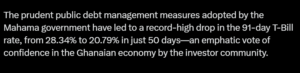

Forson further touted a sharp decline in the 91-day T-bill rate from 28.34% to 20.79% in just 50 days, crediting this to prudent debt management and strong investor confidence in Ghana’s economy.

But in a scathing rebuttal, IERPP, a respected policy think tank focused on social reform, economic stability, and good governance, rejected Forson’s explanation, calling it misleading and evasive.

In a statement signed by Executive Director Dr. Frank Bannor, IERPP questioned the logic behind Forson’s claim of “net borrowing” and argued that the government’s total borrowing stood at a staggering GHS67 billion.

“What does Ato Forson mean by ‘net borrowing’ of GHS7 billion? Honourable minister, you have borrowed GHS67 billion! If we go by your logic, then Ken Ofori-Atta never borrowed either. Is government not a continuum? How do you take credit for external debt forgiveness and then absolve yourself from honoring existing liabilities?” the statement read.

IERPP further exposed several key debt management moves that contradict Forson’s claims:

- $117.3 million (GHS672 million) buyback of a 2023 maturing Eurobond issued by the NDC in August 2013.

- $1.257 billion used for further liability management in the domestic debt market.

- $830 million from a $2 billion bond raised in 2018 to switch a 2022 maturing Eurobond with a 9.25% coupon rate, which was issued under the NDC in September 2016.

IERPP maintained that the Finance Minister must be transparent about the true state of Ghana’s debt rather than playing with financial jargon.

“The Honourable Finance Minister should spare Ghanaians the financial rhetoric! This administration has borrowed massively in just a few months, and the people of Ghana deserve the full truth,” the think tank concluded.

The clash between the government and economic analysts is intensifying, with calls for greater transparency in debt management and fiscal policies as Ghana navigates its economic recovery.

Click the link Puretvonline.com | WhatsApp Channel to join the WhatsApp channel

GOT A STORY?

Contact/WhatsApp: +233243201960 or Email: manuelnkansah33@gmail.com