adverts

MTN is making progress with its plan to separate its fibre infrastructure business, having acquired assets in Zambia and moving forward with its $315.881 million building project between East and West Africa.

“Our focus is to push ahead with the fibre business under the Bayobab construct,” MTN group CEO Ralph Mupita said during a media briefing on Monday.

In recent years, MTN has ramped up its fibre-building efforts in Africa, where it already operates the largest mobile network. As part of the expansion, the group is working to create a separate fibre unit, following the separation of it fintech business.

adverts

The group has long argued that the value of such assets is not truly reflected in its share price.

Mupita said the group’s recently rebranded infrastructure unit, Bayobab — formerly MTN Global Connect — had acquired the fibre assets of MTN Zambia and “added fibre operating licences in a few markets”. He said engagements with authorities to secure regulatory clearances in key markets were a focus for the group.

“We’re expanding with Africa50 with the east to west fibre build-out, spending over $320m to build that link. Given the cable cut we saw a week ago, that is obviously an important investment going forward. The fibre structural separation is a key priority for us and we’ll have more to say as the year goes on,” he said.

In May 2023, Bayobab entered into a partnership with Africa50 to develop Project East2West, “a terrestrial fibreoptic cable network connecting the eastern shores of Africa to those on the continent’s west”.

Friendly competition to see which company can have the largest cross-continental fibre network appears to have developed between the JSE-listed group and Strive Masiyiwa’s Liquid Intelligent Technologies.

Both companies purport to have more than 100,000km of fibre assets on the continent, with MTN having a stated goal of reaching 135,000km by 2025. While Liquid has tended to focus on the Cape Town to Cairo route, covering the south-north axis of Africa, MTN and its partners are looking at the east-west pivot.

MTN’s new partnership is set to invest up to $320m connecting 10 countries by 2025. The group now has 114,000km of fibre.

Confidence for such a separation is likely to be bolstered by success in the group’s fintech unit and interest from finance houses in telecom infrastructure businesses.

In January, payments giant Mastercard invested $200.795 million in MTN’s fintech business as part of a plan to partner with industry experts that will help to grow that new revenue line. The transaction values the unit at $5.2bn, meaning Mastercard has taken a 3.8% stake in the business.

On the funding front, Vumatel and Dark Fibre Africa’s parent company, Maziv, secured a $1.316 million loan led by Standard Bank for a fibre expansion initiative in late 2023. This marked the largest syndicated loan in SA’s telecom history, indicating that the group may outspend competitors in expanding its fibre network.

In 2022, Standard Bank backed MetroFibre Networx’s $263.243 million fibreoptic expansion through a similar arrangement.

Seacom, one of Africa’s largest undersea cable providers, recently received backing from the International Finance Corporation in the form of a $260m loan.

These developments point to a number of funding options that are open to MTN for its fibre expansion.

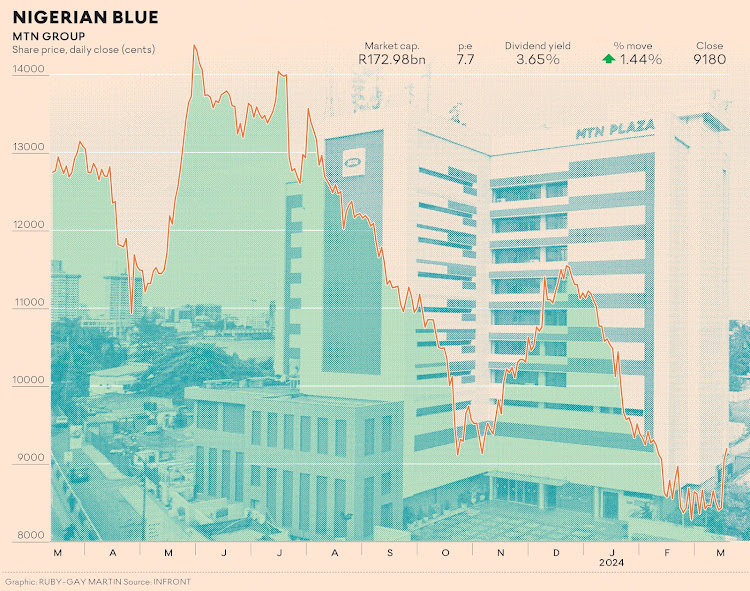

This comes amid the negative impact of Nigeria’s currency devaluation on its operations and earnings in 2023.

Reported headline earnings per share (HEPS) for the year to December 2023 were down 72.3% to 315c, with non-operational effects having decreased HEPS by 888c.

Total subscribers increased to 295-million across MTN’s 19 markets. High demand for data and fintech services saw the number of active data subscribers grow by more than 9% to 150-million, half the total subscriber base, and active mobile money users up 5% to 72.5-million.

Group service revenue grew 6.9% to $11.062 million . In constant currency, this growth stood at 13.5%. Earnings before interest, tax, depreciation and amortisation (ebitda) — before one-off items — was down 0.5% to $4.765 million.