adverts

The 2024 Fintech Sector Report released by the Bank of Ghana has shown that the total value of mobile money accounts with commercial banks by the end of March 2024 reached GH¢18.69 billion cedis.

The report described this as Balance on Float.

adverts

The figure represents 7.5 percent jump over what was recorded in February 2024.

The report also showed that since February 2023, the GH¢18.69 billion is the highest Balance on Float over the past 14 months.

The Balance on Float can be described as the combination of customer, agent, partner banks and the service provider’s own cash deposit against which they have been provided Electronic Money.

This can also be described as one of the effective tools that can be used to mobilize money outside the banking system.

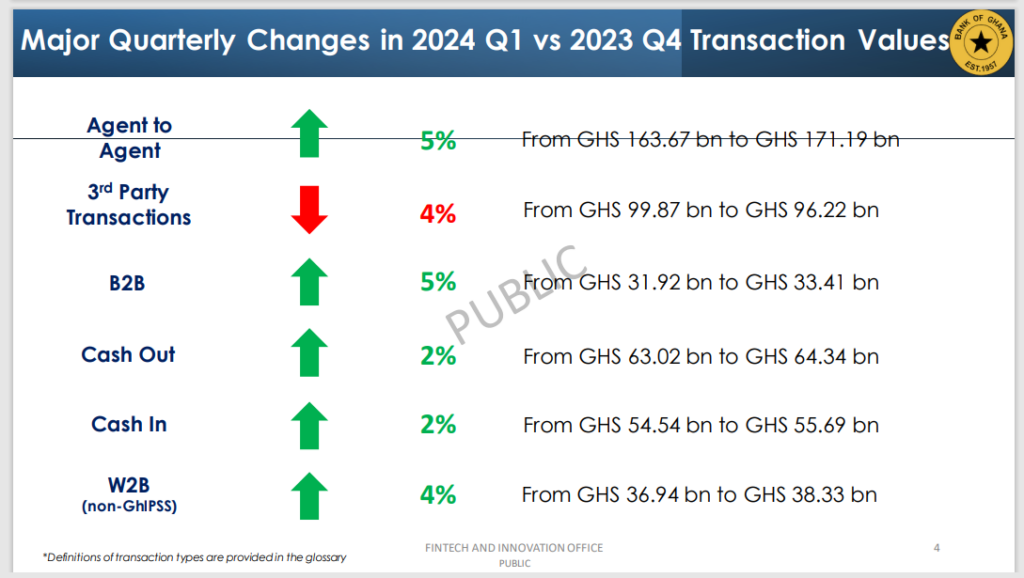

The report also showed that the total value of mobile money transactions, reached GH¢576 billion in the first three months of 2024.

This represents 33.4 percent increase over GH¢431 billion realized in the same period for 2023.

On the other hand, total volume of transactions for the first quarter of 2024, stood at GH¢1.86 billion, this also represents 21.6 percent over what was recorded in the same period for 2023.

Total registered customer accounts ending March 2024 stood at GH¢67.3 million. Registered mobile money agents was 835, 000.