adverts

Ghana Tops Africa in Mobile Money, Leads West Africa in Fintech Regulation — IMANI VP

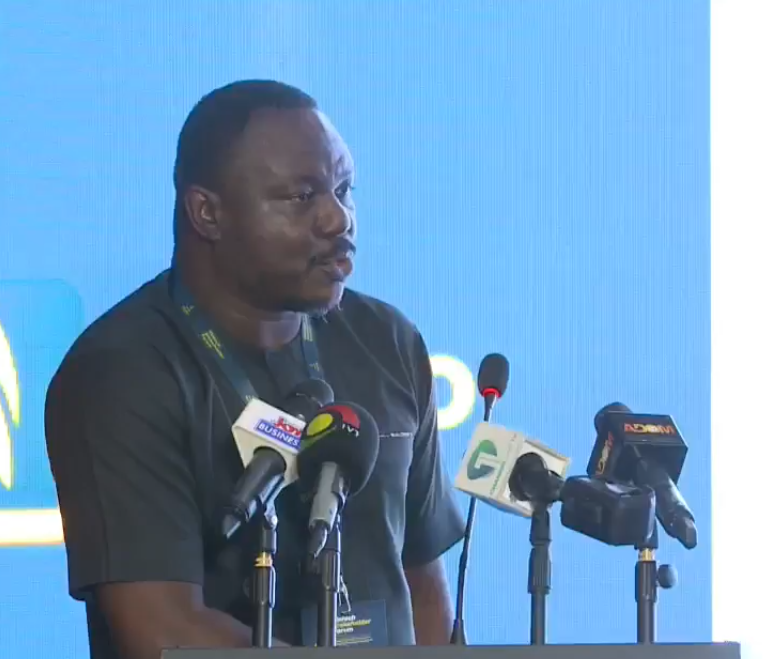

Ghana has emerged as Africa’s number one mobile money hub and the leader in financial regulatory systems in West Africa, according to Selorm Brantie, Vice President of IMANI Africa.

He says the country’s robust regulatory architecture and thriving digital finance ecosystem place it ahead of many African peers, including Nigeria and Kenya, in several key areas.

Speaking at a recent forum on digital financial innovation, Mr Brantie emphasised that Ghana’s regulatory journey has been strategically built to power financial activity both domestically and internationally.

adverts

“If you want to look at the regulatory framework or the way the system is structured, the Bank of Ghana stands at the top as the primary regulatory authority,” he explained. “They are powered by foundational laws such as the Non-Bank Financial Institutions Act (Act 774), the upcoming Digital Credit Services Directive, the draft Digital Assets Guidelines, and the Virtual Asset Service Providers Regulation. Together, these form a layered and comprehensive system that is unmatched in West Africa.”

Mr Brantie outlined Ghana’s regulatory ecosystem in three tiers:

- Primary Regulatory Authorities

At the apex is the Bank of Ghana, responsible for regulating digital credit and payment services. It works closely with other key agencies such as the Securities and Exchange Commission (for digital assets and capital markets), the Data Protection Commission (for personal data safeguards), the Financial Intelligence Centre (for anti-money laundering), and the National Communications Authority (which oversees the telco infrastructure that underpins mobile money). - Supporting Legislative Ecosystem

Complementary laws, including the Data Protection Act, Anti-Money Laundering Act, Cybersecurity Act, Payment Systems and Services Act, Electronic Transactions Act, and Credit Reporting Regulations, ensure consumer protection, financial stability, and seamless integration between finance and technology. - Service Provider Structure

Ghana has over 70 licensed fintech providers operating under clear compliance matrices — covering licensing, capital adequacy (minimum GHS 2 million in some cases), KYC, AML, data protection, and consumer protection requirements.

This multi-agency, multi-layered model, he said, mirrors best practices from advanced economies like the EU, Switzerland, and Singapore, while being tailored to Ghana’s local realities.

Ghana’s dominance in mobile money is undisputed. As of 2023:

- 77 million mobile money accounts were active nationwide.

- Annual transactions hit GHS 1.9 trillion, with projections to reach GHS 2.5 trillion by the end of 2025.

- There are 938,000 registered agents, including merchants and service providers.

- MTN Ghana alone has over 17.2 million active subscribers, recording a 13% year-on-year growth and generating GHS 4.4 billion in revenue.

- Recovery rates on digital lending products via mobile money stand at 90%, outperforming many traditional banks.

“When it comes to mobile money, Ghana is number one on the continent,” Mr Brantie declared. “We’ve built not just scale, but structure—a regulatory environment that supports innovation while protecting consumers.”

Despite these successes, Mr Brantie pointed out some gaps. Notably, sandbox testing mechanisms — critical for piloting fintech innovations — have not been fully deployed, causing 18–24 month delays for startups trying to bring products to market. He also highlighted understaffing at the Financial Intelligence Centre, which affects fraud monitoring and regulatory enforcement.

Additionally, while Ghana’s digital asset guidelines are promising, he said clearer coordination between regulators is needed to fully integrate crypto assets into the formal economy.

“We have 3.4 million Ghanaians actively trading in crypto — around 17% of the adult population — with an annual $3 billion market opportunity. If we can harmonise our open banking and digital asset frameworks, we can cement Ghana’s position as Africa’s regulatory and fintech leader.”

Comparatively, Ghana outpaces Nigeria in most regulatory areas and is on par with Kenya while aspiring to emulate the UK’s gold standard in open banking and consumer protection.

Mr Brantie believes that if Ghana implements a national data harmonisation framework and deepens multi-agency coordination, it can sustain its number one spot in mobile money and fintech regulation across Africa.

“Ghana has the right building blocks. What remains is to harmonise, strengthen institutions, and keep innovation flowing. We are not just competing in West Africa—we are setting the pace for the continent,” he concluded.

Click the link Puretvonline.com | WhatsApp Channel to join the WhatsApp channel

GOT A STORY?

Contact/WhatsApp: +233243201960 or manuelnkansah33@gmail.com