adverts

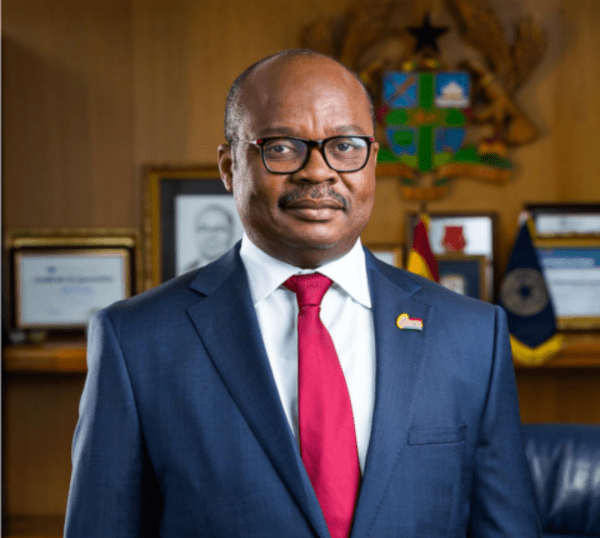

BoG Governor Addison Admits Incomplete Financial Sector Cleanup Amid Savings and Loans Challenges

Governor of the Bank of Ghana (BoG), Dr. Ernest Yedu Addison, has acknowledged that the cleanup of Ghana’s financial sector remains incomplete, particularly within the Savings and Loans (S&L) subsector.

Speaking on PM Express Business Edition on January 2, Dr. Addison cited budgetary constraints as the primary reason for delays in revoking licenses for troubled institutions, leaving some depositors unable to access their funds.

“The legacy we inherited, especially on the S&L side, includes some institutions that are still in trouble. Their licenses have not been revoked because the government does not have the resources to refund the deposits,” Dr. Addison revealed.

adverts

He emphasized that the delay was not due to oversight but a lack of financial resources, noting that the central bank had waited for three years to secure the necessary budgetary support.

Despite the challenges, Dr. Addison assured that the unresolved issues posed minimal risks to the broader financial system. “Fortunately, these are not systemic institutions. Their size and exposure will not significantly impact the financial sector,” he explained.

Addressing the frustrations of depositors still awaiting refunds, Dr. Addison affirmed that the issue was under discussion with the International Monetary Fund (IMF) and would be resolved once budgetary allocations were secured.

Reflecting on broader cleanup efforts, Dr. Addison highlighted the substantial progress made in addressing depositor concerns across other financial institutions.

He admitted that the government’s generous compensation approach, which included paying both principal and accrued interest, significantly increased the cleanup costs but ensured most depositors received their funds.

Dr. Addison concluded by reiterating the importance of completing the cleanup to restore confidence in the financial sector. “The banking sector cleanup was about creating a foundation for long-term growth. We must ensure that all aspects, including the savings and loans sector, can effectively fulfil their roles,” he said.

His remarks underline the delicate balance between fiscal limitations and the need to rebuild trust in Ghana’s financial system.