adverts

aYo Pays GH¢14m In Claims In 2025 As Insurance Adoption Soars

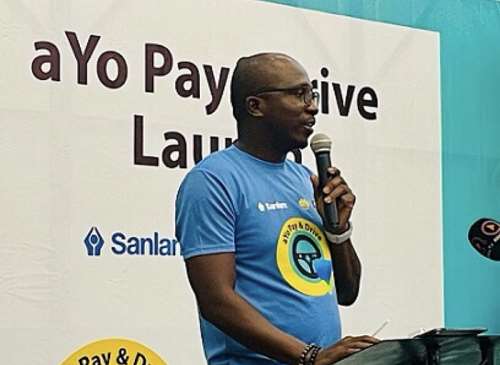

The Chief Executive Officer of aYo Intermediaries Ghana, Francis Gota, has disclosed that the company recorded a 41 percent growth in revenue, climbing from GH¢71 million to GH¢100 million in 2025, while paying out about GH¢14 million in insurance claims, more than double what was paid in the previous year.

Mr Gota made the disclosure at the aYo Excellence and Thanksgiving Awards, describing 2025 as a defining year shaped by resilience, adaptability and strong partnerships, despite operational challenges including system disruptions and power outages.

“God has been good to us. The year stretched us and tested our patience, but what stood out most was our response,” he said, commending staff and partners for remaining focused and united under difficult conditions.

adverts

According to the aYo CEO, the leap from GH¢71 million to GH¢100 million reflects the growing acceptance of insurance among underserved communities, a core focus of the company’s mission.

“This growth shows that insurance works, and aYo is making insurance work for the people,” Mr Gota stated.

He explained that the company’s success goes beyond revenue figures, stressing that millions of lives were insured and timely financial relief was delivered to families and small businesses affected by health emergencies, income loss and unforeseen shocks.

Mr Gota revealed that GH¢14 million was paid in claims in 2025 alone, offering critical support to thousands of households nationwide.

“This is real protection, not just numbers,” he said. “It is about strengthening household resilience and reinforcing insurance as a trusted financial safety net in Ghana.”

The CEO emphasised that financial inclusion cannot be achieved by technology alone but through people working together, listening to customers and continuously adapting to human needs.

“Our vision is clear: a future where everybody uses insurance, not just buys insurance,” he noted.

He praised the aYo team and its partners for their professionalism, unity and dedication, describing them as the backbone of the company’s growth. He also acknowledged partnerships dating back to April 4, 2017, highlighting the role of collaboration in aYo’s journey.

Looking ahead, Mr Gota expressed confidence in the future of insurance in Africa, saying success would favour organisations that collaborate openly, adapt quickly and remain deeply human in their approach.

“As we celebrate GH¢100 million in revenue and GH¢14 million in claims, we must also celebrate the sacrifices, lessons and relationships that made these milestones possible,” he concluded.

He thanked staff, partners, regulators and customers for their trust and resilience, urging all stakeholders to remain inspired to do even more in the years ahead.

Click the link Puretvonline.com | WhatsApp Channel to join the WhatsApp channel

GOT A STORY?

Contact/WhatsApp: +233243201960 or manuelnkansah33@gmail.com