adverts

Airtel Africa has posted its highest quarterly revenue growth in recent times, recording a 22% year-on-year increase to $1.42 billion in Q2 2025.

The performance was buoyed by rising demand for data and voice services, with data services generating $549 million and voice contributing $533 million. The company’s EBITDA jumped 30% to $679 million, pushing profit margins to 48%, up from 45.3% a year ago.

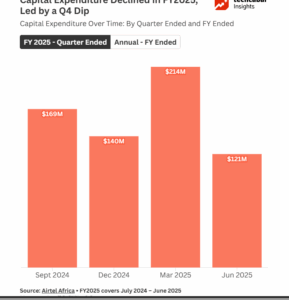

Yet despite the stellar financials, the telecom giant is drawing concern over a sharp cut in infrastructure investment. Capital expenditure (capex) fell 18% year-on-year to $121 million, its lowest in four quarters and a 56% drop from the previous quarter.

adverts

Airtel Africa, which operates in 14 African markets, has now recorded three consecutive years of declining annual capex. Between June 2024 and June 2025, it spent $670 million, down from $737 million the previous year, and $748 million before that.

In Nigeria, its largest and most profitable market, revenue hit $332 million in Q2—about 24% of group revenue—but investment barely moved, rising slightly from $38 million to $39 million. That’s just 1.7% of group capex, underscoring what analysts say is a worrying mismatch between Nigeria’s strategic importance and Airtel’s reinvestment levels.

In East Africa, capex plummeted from $77 million to $43 million, while Francophone Africa saw a marginal increase from $23 million to $31 million.

Though the company attributed the drop to “timing differences” and insists full-year investment will fall between $725 million and $750 million, there are growing fears that Airtel’s network quality and capacity may be strained if underinvestment continues—especially as customer demand skyrockets.

Airtel added over 2,300 new sites and expanded its fibre network by 2,700 km in Q2. But with a customer base now at 169.4 million—up 9%—each of the company’s 37,579 tower sites supports about 4,500 users. That’s roughly 22 towers per 100,000 people, in line with global norms, but barely sufficient for Africa’s rapidly urbanising and increasingly connected population.

Smartphone penetration rose from 41.6% to 45.9%, while average data usage jumped 47.4% year-on-year. Data users alone increased by 17.4% to 75.6 million.

Despite the expansion of 4G coverage to 74.7% and a total fibre backbone now exceeding 79,600 km, analysts argue that demand is quickly outpacing Airtel’s pace of infrastructure rollout.

Airtel Africa CEO Sunil Taldar assured stakeholders that the company remains committed to improving customer experience. He highlighted the launch of Airtel Spam Alert, an AI-powered tool aimed at strengthening network safety and trust.

“With smartphone usage still at 45.9%, we see plenty of room to grow and close the digital divide,” Taldar said.

But with mounting economic pressures—including currency devaluation in Nigeria, Malawi, and Zambia, and rising energy and operating costs—the company’s financial caution could undermine long-term network quality and coverage.

As Airtel Africa continues to position itself as a leader in digital and financial inclusion across the continent, it faces a critical choice: double down on infrastructure investment to sustain momentum, or risk eroding customer satisfaction and losing ground to rivals in high-growth markets.