adverts

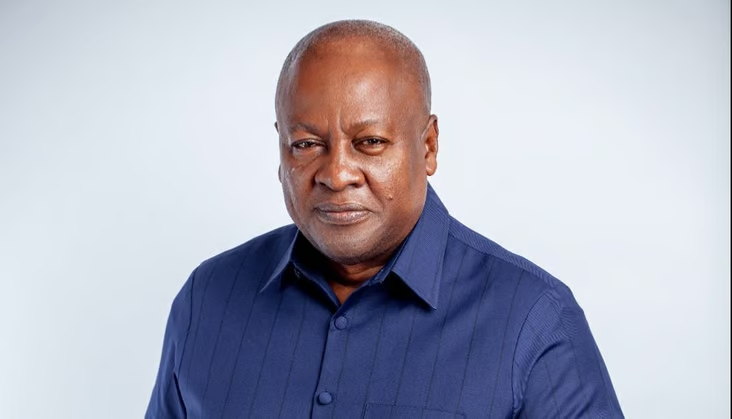

National Democratic Congress (NDC) flagbearer John Dramani Mahama has reiterated his commitment to resurrect failing banks and financial institutions in the wake of an exhaustive and objective evaluation.

He beseeched Ghanaians to overwhelmingly back him in the general elections of 2024 in order to revitalise the flagging economy, expressing alarm over the country’s rising unemployment rate.

During a Sunday, June 9 conversation with Ghanaians, Mr. Mahama acknowledged the growing dissatisfaction among the country’s youth.

adverts

“My dear youth, while I agree with your justifiable anger and disappointments, I urge you to keep hope alive. Have faith in God and the power of your thumb. Ghanaians are in search of hope—hope they can believe in! I hope with the assurance that Ghana will be reset on the path of progress and prosperity.

“Hope, knowing they can live in safe neighbourhoods and earn a living if they study hard, work hard, and live as law-abiding citizens. This is what Ghanaians are yearning for, and this is precisely what the NDC and I are presenting to you in this election of 2024.

“Exercise your franchise by voting for me, John Mahama, on December 7 and for the NDC Parliamentary Candidate in your constituency. As your selfless, truthful, experienced, and visionary leader, I need your vote to reset Ghana. I assure you, I will work with you to build a country of shared growth and prosperity.”

“I will repair the dangerous damage to our country’s economy and people,” he emphasised, “by resetting Ghana.” Businesspeople who have received unfair deals from government officials will be given a voice and guaranteed restoration. Banks and financial institutions that have collapsed will be reopened following a comprehensive and objective evaluation. With my 24-hour economy idea, we will create respectable, well-paying jobs.

“Let me be clear: I am utterly appalled and disappointed by the unprecedented unemployment rate we are seeing today.”

The number of banks was reduced from 34 to 23 during the clean-up, and the licences of 347 microfinance organisations, 15 savings and loans, and 8 finance houses were withdrawn.