adverts

Millions of Ghanaians Dive into Crypto Amid Regulatory Gaps—IMANI VP

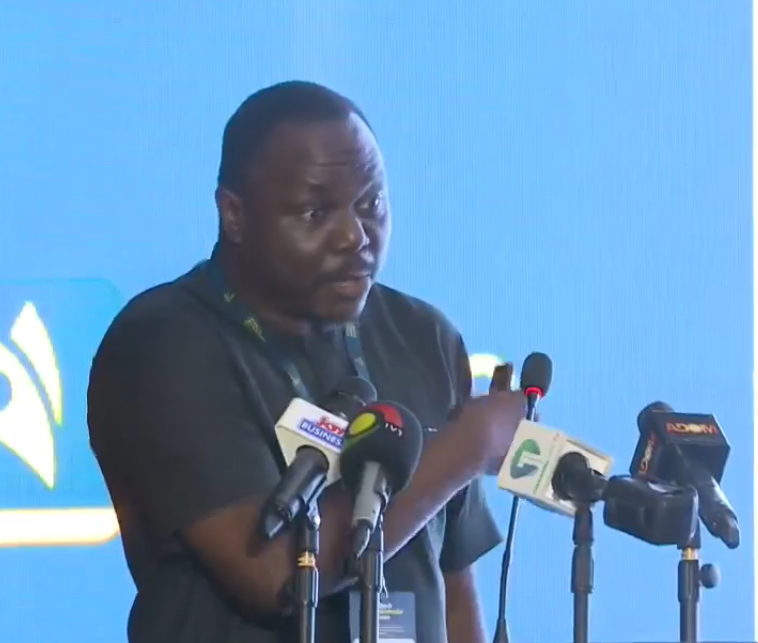

Ghana’s rapidly growing crypto community has caught the attention of policy analysts, with Selorm Brantie, Vice President of IMANI Africa, urging swift regulatory action to harness the sector’s massive economic potential.

Speaking on Ghana’s evolving digital finance ecosystem, Mr Brantie revealed that over 2.2 million Ghanaians are actively involved in cryptocurrency transactions, representing a significant and fast-expanding segment of the country’s financial landscape. This surge, he explained, is largely driven by young people who are already embedded in mobile money systems, bypassing traditional banking channels entirely.

“We are talking about millions of Ghanaians who are not waiting for formal systems — they are already transacting in crypto daily. This presents both a $3 billion market opportunity and a regulatory challenge that must be addressed urgently,” Mr Brantie said.

adverts

Currently, the Bank of Ghana serves as the apex regulator for digital finance, supported by a web of laws including the Non-Bank Financial Institutions Act (Act 774), the upcoming Digital Credit Services Directive, and draft Virtual Asset Service Providers regulations. These frameworks set capital adequacy standards, outline complaint resolution timelines, and propose sandbox testing for digital asset innovations.

However, Mr Brantie highlighted critical gaps in coordination and deployment, especially regarding sandbox testing and data protection mechanisms, which have left parts of the crypto space largely unregulated.

“While we have strong laws on paper, the practical coordination between regulators like the Bank of Ghana, the Securities and Exchange Commission, the Financial Intelligence Centre, the Data Protection Commission, and the NCA is still fragmented,” he observed. “This lack of alignment slows innovation by up to two years and leaves a booming market largely untapped.”

He noted that Ghana’s fintech sector has already attracted $120 million in capital and operates in a market worth $192 billion, with over 77 million mobile money accounts and nearly a trillion cedis in transactions annually. The rise of crypto, therefore, represents not a fringe movement but a mainstream shift in how Ghanaians handle money.

Despite this momentum, Ghana faces a regulatory contradiction: crypto is not legal tender, yet millions trade it freely, often converting digital currencies to cedis through mobile money. This creates significant blind spots in tax collection, consumer protection, and anti-money laundering enforcement.

Drawing lessons from Switzerland, Singapore, and the EU, Mr Brantie proposed a multi-agency regulatory approach, clearer token classification, and the creation of a public registry of licensed virtual asset operators. He believes such measures would position Ghana as a continental leader in crypto regulation.

“Ghana is already ahead of many African countries. If we harmonise our open banking and crypto frameworks, we could cement our place as number one in Africa’s digital finance space,” he asserted.

Click the link Puretvonline.com | WhatsApp Channel to join the WhatsApp channel

GOT A STORY?

Contact/WhatsApp: +233243201960 or manuelnkansah33@gmail.com