adverts

In November 2024, Ghana took a bold step toward a fairer, faster, and more modern telecom sector by licensing the first wholesale shared network for nationwide 4G and exclusive 5G service.

This neutral, wholesale-only platform, led by special purpose vehicle (SVP) Next-Gen Infrastructure Company (NGIC), is intended to fix long-standing market problems: poor coverage quality, unequal investment incentives, and the outsized dominance of one operator—MTN Ghana.

But months after launch, the dominant player and only significant market power (SMP) appear reluctant to come on board.

adverts

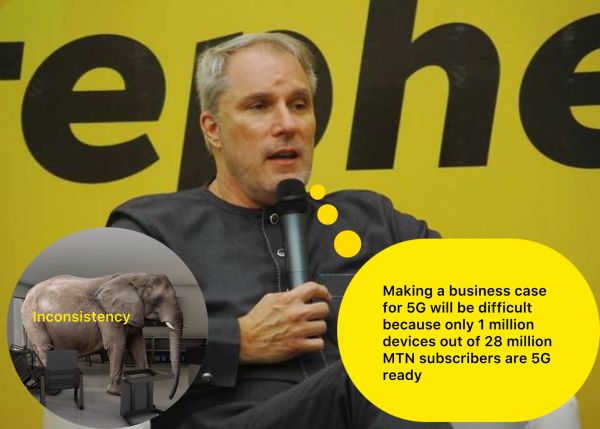

MTN Ghana’s CEO, Stephen Blewett, recently questioned the business case for 5G in Ghana, citing low adoption of 5G-capable devices among MTN’s 28 million customers. At his first ever media engagement in April this year, he claims MTN has only one million 5G-capable devices on its network, and that is not enough to make a business case. This stance raises crucial questions—not just about MTN’s strategy, but about the credibility of government policy, the success of the shared network model, and the future of Ghana’s digital economy.

Blewett did say that MTN “will surely participate in 5G” in the future, either via NGIC or another arrangement. But for now, they are “waiting on the minister for direction.”

Watch the video below:

https://youtu.be/e6-m6tolTYc?si=HrDvqk5Ff3eoNKkp

His comments are particularly similar to what a former Vodafone Ghana CEO, Yolanda Zuleka Cuba, said about 4G in August 2016, and also what the onetime Tigo Ghana CEO, Carlos Carceres, said about the Mobile Number Portability (MNP) policy in February 2011. Eventually, the two companies lost out heavily on those two policies – 4G and MNP.

NGIC and Ghana’s 5G Policy

To address Ghana’s fragmented 4G rollout and tackle market imbalance, the government awarded NGIC a 10-year licence (2024–2034) to serve as the single wholesale platform for 4G (non-exclusive) and 5G (exclusive) services nationwide.

Under this model:

- 4G is shared wholesale (any operator can build, but NGIC is meant to offer a neutral, cheaper, high-quality wholesale alternative).

- 5G is exclusive to NGIC for wholesale—no other company can build standalone 5G networks during this period.

The idea is to reduce duplication of infrastructure, promote fair competition, and expand high-speed broadband to underserved areas.

Indeed, the Minister for Communication, Digital Technology and Innovation, Sam George, did state at his Q2 2025 media briefing that the shared model is “a deliberate policy shift to address infrastructure implications, lower data cost, and accelerate universal 5G access for all Ghanaians.” In fact, while he was in opposition as head of John Mahama’s Manifesto Committee on Communications and Digital Technology, Sam George told Techfocus24 that the NDC fully supports the shared model for 5G rollout because it was contained in the NDC 2020 Manifesto.

Also Read: NDC manifesto supports 5G shared network – Sam George

So, if the MTN Ghana CEO says he is waiting for a policy direction from the Ministry, that policy direction was clearly articulated by the Minister as recently as July 3, 2025.

At this stage, AT Ghana and Telecel Ghana have both been granted connecting entity licences to connect to NGIC because they applied for them. MTN has still not even bothered to apply.

Even though no specific deadline has been given for the anchor telcos to connect to NGIC, the regulator, the National Communication Authority (NCA), has clearly communicated a policy position that ISPs (internet service providers) will only be considered for connecting entity approval six months after NGIC begins commercial operations.

MTN’s refusal to apply for a connecting entity licence raises a crucial regulatory question: if the dominant operator controlling almost 80% of the mobile data market share doesn’t participate in the shared 5G platform, can Ghana’s digital transformation succeed?

Fact Check: Hasn’t MTN Wanted 5G Before?

Yes, they have—and that’s what makes the current stance so puzzling.

In 2021, MTN Ghana proudly announced it had 1,322 sites ready for 5G rollout. MTN then lobbied the government for a 5G licence. In fact, MTN Group’s CEO even personally pressed President Akufo-Addo for 5G approval at the World Economic Forum in New York.

This was four years ago. At that time, there were surely fewer than one million 5G-capable devices on the MTN network and in Ghana as a whole.

So why is it that, in 2025—when more 5G devices are on MTN and in the market, and when a cheaper shared model is available—the business case is suddenly “not there”?

Why is MTN suggesting to Ghanaians that seeking to acquire a standalone 5G licence at a higher price to serve fewer 5G customers made a better business case in 2021 than serving more 5G customers under a relatively cheaper shared model now?

The logic doesn’t seem consistent, unless the current MTN Ghana CEO is suggesting to Ghanaians that his predecessor, Selorm Adadevoh, and Group CEO, Ralph Mupita’s decision to lobby the government for a standalone 5G licence years back was a bad business decision.

More Confusion from MTN

In fact, just last week, barely five months after Blewett’s confusing comment, the MTN Group CEO, Ralph Mupita, was reported to have told journalists that MTN has held discussions with the Ghana government and regulators, setting the stage for a rollout of 5G on MTN Ghana soon. This announcement by the Group CEO deepens the confusion further as to whether MTN has suddenly found a business case for 5G now or it is just a matter of MTN not being interested in the current government policy of a shared model for 5G rollout in Ghana.

Mupita’s recent comments do not only expose the inconsistencies in MTN’s position on the 5G conversation in Ghana but also expose a worrying inconsistency in the government’s policy. It is important to note that NGIC has a 10-year exclusivity to 5G rollout in Ghana, and the minister has stated clearly that the shared network model is a deliberate policy shift for very good reasons. So, if the government is truly engaging with MTN on a possible standalone 5G licence, that flies in the face of the exclusivity clause in NGIC’s licensing terms. It also hampers the confidence of investors who are tracking these developments closely.

What MTN Knows (But Isn’t Saying Out Loud)

MTN is one of Africa’s most sophisticated telecom operators. Its group strategy—”Ambition 2025″—is built around moving from being just a telecom company to a technology company. One of its pillars is Enterprise Solutions.

And the real value of 5G isn’t only in consumer handsets—it’s in enterprise and industrial uses such as

- Mining and oil & gas

- Logistics and smart factories

- AI-powered agriculture

- Advanced financial services

- Healthcare and education, etc.

Per this writer’s understanding, these sectors need ultra-low latency, high-capacity networks. That is the real 5G business case. In fact, Mupita acknowledged this during his recent media engagement in Ghana.

MTN knows this better than anyone—which makes the Ghana CEO’s public argument about the number of 5G-capable devices ring hollow and confusing.

Policy Confusion—and a New Extension

Another confusion comes from the government’s own mixed signals in managing spectrum and competition.

Earlier this year, the Ministry granted MTN additional 4G spectrum under a “technology neutrality” policy—but crucially, that allocation did not allow MTN to use it for 5G. Officially, this extra 4G capacity was meant to address pressing network quality issues, especially urban congestion.

While this move is intended to deliver short-term relief for consumers, it also created the perception that the government was willing to make regulatory concessions to its dominant player—even while promoting an NGIC-led shared network vision for 5G.

Again, that inconsistency undermines confidence in the policy and sends a confusing signal to investors and competitors.

Meanwhile, recognising deployment delays and technical challenges, the Minister for Communications, Digital Technology and Innovation, Sam George, recently granted an extension for NGIC to complete its network rollout and become fully operational. He specifically stated that NGIC is expected to roll out at least 50 5G sites in Accra and Kumasi by Q4 this year.

But there’s a critical gap: the Minister did not set a clear deadline for the anchor telcos to connect to NGIC’s wholesale platform once it is ready.

This is important. Without a firm mandate for the retail operators to onboard NGIC’s wholesale service, the consumer experience remains unaddressed. NGIC might be ready to deliver affordable shared 4G and exclusive 5G capacity—but unless the MNOs and ISPs are required to use it on clear timelines, the policy’s benefits could stall at the wholesale level, never reaching end users.

All these, coupled with the fact that the minister only casually asked MTN to apply for a connecting entity license and join the NGIC “if they so wish”, and the minister’s threat to review the terms of the NGIC license if they fail to meet the Q4 2025 deadline, seem to suggest that there is a grand agenda to make NGIC fail just to justify why MTN should be given a standalone 5G license.

Also Read: Elephant in the Room: Why Ghana missed the June deadline for 5G rollout

Allegations of Vendor Pressure and Anti-Competitive Tactics

Meanwhile, multiple industry sources allege that certain vendors—companies providing managed services to several telcos—have been pressured not to work with NGIC.

Some say they’ve been warned they could lose contracts with big players (including a telco and certain infrastructure companies) if they support the shared wholesale rollout.

If true, this is classic anti-competitive behaviour that would warrant serious regulatory investigation.

Even more troubling, some insiders claim lobbying efforts have been made to delay development finance institution (DFI) funding for NGIC, suggesting that the policy environment might shift back to favouring standalone 5G licences in the future.

Why Every Ghanaian and Stakeholder Should Care

This isn’t just a fight among telecom giants. It affects all of us.

If MTN is allowed to “wait it out” indefinitely, and if vendors and smaller operators are pressured into silence or delay, Ghana risks:

- Higher mobile data prices

• Slower, fragmented 5G rollout

• A wider digital divide between urban elites and rural areas

• A creeping private-sector monopoly over national telecom infrastructure

Telecoms are the backbone of our digital economy. Letting one player dominate unchecked threatens competition, innovation, investment—and ultimately, the welfare of every Ghanaian consumer and business.

What Needs to Happen Now

- The Ministry and NCA must enforce policy coherence: The NGIC licence is a legal and strategic framework designed to deliver affordable, nationwide 4G and exclusive 5G through shared infrastructure. It must be consistently enforced—or transparently amended through due process. Mixed signals about spectrum policy and technology neutrality undermine investor confidence and the entire shared-network strategy.

- Deadlines for operator onboarding must be clear: the government cannot simply declare NGIC “ready” while leaving retail service in limbo. The Ministry and NCA should set binding, enforceable timelines for mobile network operators (MNOs) and ISPs to connect to the platform so consumers actually see the benefits.

- The NCA must ensure a fair, transparent pricing regime: As regulator, the NCA is responsible for approving NGIC’s wholesale pricing to ensure it is affordable, competitive, and incentivises uptake—while guaranteeing quality of service. This is essential for avoiding monopolistic pricing and ensuring the policy meets its equity goals.

- NGIC must deliver on coverage and quality commitments: NGIC itself has to earn trust. It must ensure its wholesale service is reliable, nationwide, and technically robust, with clear service-level guarantees. Without nationwide coverage and quality infrastructure, operators will have an excuse to delay onboarding or lobby for alternative licences.

- MTN must clarify its position: is it simply stalling to renegotiate the rules, or is it genuinely committed to Ghana’s shared 5G future? Given its market dominance, MTN’s intentions matter enormously for policy credibility and industry planning.

- Allegations of vendor intimidation must be investigated: Regulators should urgently investigate claims that vendors are being threatened or penalised for working with NGIC. Procurement integrity is non-negotiable for building trust and ensuring true neutrality.

- Ghanaians and all stakeholders must stay informed and engaged:Ultimately, this is not just an industry dispute. It’s about whether Ghana will build a fair, competitive, future-ready telecom market—or cede control to private monopolies. Public scrutiny and debate are essential to hold all parties accountable.

No response from MTN

It is only fair to state that, even though the MTN Ghana CEO made his position clear in the video insert above, this writer still wrote to MTN Ghana seeking further clarification of his comments. The request was submitted to MTN on July 7, 2025, but to date (more than two months later) MTN is yet to respond to the request, even after several follow-ups.

NGIC’s Response

This writer also wrote to NGIC seeking its response to concerns raised about its readiness. Unlike MTN, the company gave three very key responses to which the public can hold them going forward:

- By Q4 this year, NGIC will switch on 50 live 5G sites in Accra and Kumasi, all connected to a new cloud-based 5G core network. In simple terms, this ‘core’ is the brain of the system.

- On partnerships, NGIC has signed agreements with tier-one equipment providers such as Nokia, is in discussions with cloud and data centre partners to enable edge computing, and has advanced talks with development finance institutions (DFIs) to support the first phase of rollout.

- Importantly, NGIC has now closed a landmark agreement with Ghana’s leading TowerCo (ATC Ghana). This gives NGIC ready access to thousands of existing tower sites nationwide, allowing them to expand beyond Accra and Kumasi without wasting time or money duplicating infrastructure.

Final Thoughts

This is a defining moment for Ghana’s telecom future.

We can choose to build a fairer, more competitive, future-ready network—or slide into monopoly, fragmentation, and policy confusion.

MTN is a central player in this story. But so are government regulators, the Ministry, vendors, investors—and you, the Ghanaian consumer.

Today, the government is having to use what many have described as “bullying tactics” to try and whip South African pay-TV monopoly, Multichoice (DSTV), in line over prices. Meanwhile, there is a bigger threat of a monopoly in the telecom industry, and the government seems to be encouraging it. A sequel to this article will look at that matter in detail, plus the implications of an AT Ghana and Telecel Ghana merger for the shared 5G network model.

Let’s all put Ghana first.

Source: Samuel Dowuona

The author, Samuel Dowuona, is a multiple award-winning telecoms and technology journalist. He can be reached at dowuonasamuel24@gmail.com.

Click the link Puretvonline.com | WhatsApp Channel to join the WhatsApp channel

GOT A STORY?

Contact/WhatsApp: +233243201960 or manuelnkansah33@gmail.com