adverts

Finance Minister Dr. Cassiel Ato Forson has announced that the government will reopen the domestic bond market in August 2025 as part of a renewed debt management strategy aimed at reducing borrowing costs and bolstering fiscal stability.

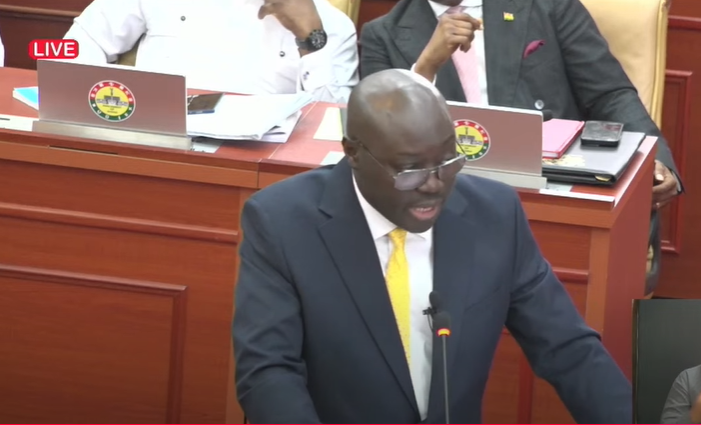

Presenting the 2025 Mid-Year Budget Review to Parliament on Thursday, July 24, Dr. Forson revealed a strategic shift in how the government plans to handle public borrowing, with treasury bills now reserved solely for short-term cash management purposes.

“Our debt management strategy is to use treasury bills for cash management only and reopen the domestic bond market to finance the budget deficit,” the minister told lawmakers.

adverts

The move is expected to create a more competitive and efficient primary bond market, offering better volume and pricing conditions to help the government lower its cost of borrowing.

As part of the preparations, Dr. Forson announced that the government will begin selecting new bookrunners—qualified financial institutions responsible for managing and distributing government bonds—from August.

“The focus will be on banks and investment dealers with the capacity to ensure wider market distribution and offer advisory services on pricing and structuring,” he stated.

The decision forms part of a broader government commitment to restoring investor confidence, strengthening Ghana’s domestic capital markets, and promoting long-term debt sustainability.

The Finance Ministry says the revamped approach will play a crucial role in supporting economic recovery while ensuring more transparent and cost-effective public debt management.

Click the link Puretvonline.com | WhatsApp Channel to join the WhatsApp channel

GOT A STORY?

Contact/WhatsApp: +233243201960 or Email: manuelnkansah33@gmail.com