adverts

Ghana has emerged as the only African country with fully interoperable multiple instant payment systems (IPS), according to KPMG’s 2024 West Africa Banking Industry Customer Experience Survey.

The country outperforms regional counterparts such as Morocco, South Africa, Egypt, Nigeria, Kenya, and Tanzania in digital payment integration.

This distinction highlights Ghana’s leadership in financial technology and digital transactions across the continent.

adverts

The State of Inclusive Instant Payment Systems in Africa Report 2024 reveals that Africa has 28 IPS spread across 20 countries. While seven nations operate multiple IPS, Ghana stands out as the only country where these systems are fully interoperable, ensuring seamless fund transfers between different platforms.

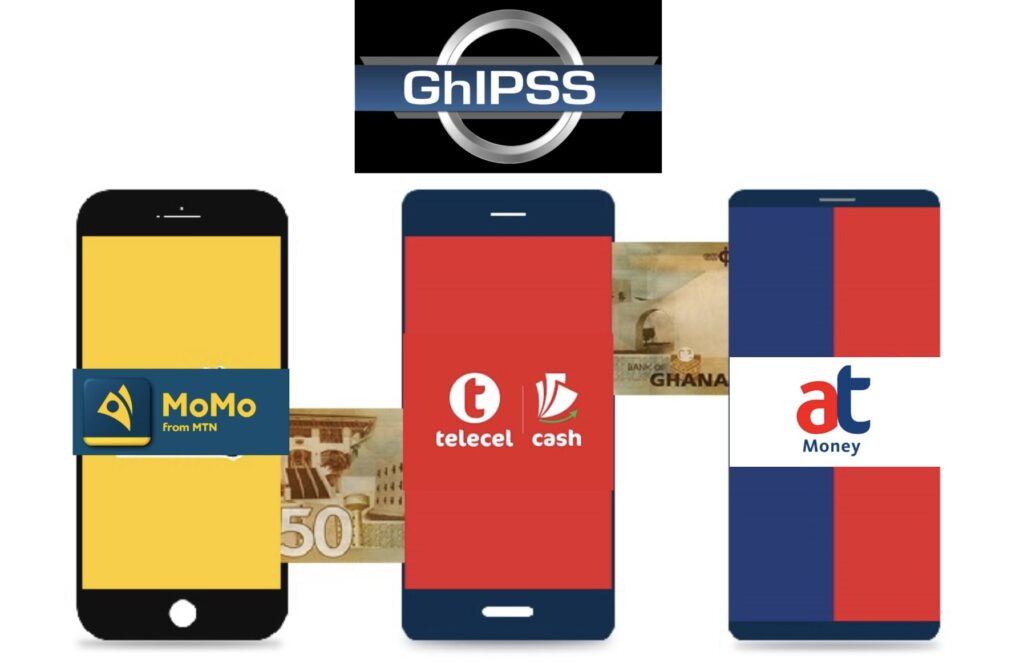

Ghana operates two key IPS:

- GhIPSS Instant Pay (GIP) – Facilitating real-time transactions across banks and financial institutions.

- Mobile Money Interoperability (MMI) – Enabling seamless mobile money transactions across different network providers.

These two systems interact seamlessly, enhancing customer experience and driving financial inclusion.

The adoption of IPS in Ghana has yielded substantial benefits. As of October 2024:

- The value of transactions processed through GIP surged by 174% compared to the same period in 2023.

- Total transaction volume increased by 32% year-on-year.

- Mobile money remains the dominant payment method, with total transactions reaching GHS 2.36 trillion, marking a 55% year-on-year growth.

- The number of mobile money transactions increased by 20%, totaling 6.6 billion transactions.

These figures underscore the role of IPS in advancing financial inclusion and improving transaction efficiency in Ghana. These secure, real-time payment platforms are revolutionizing how individuals, businesses, and financial institutions engage with the digital economy.

According to the report, Ghana’s progressive payment landscape is driven by:

- Regulatory Oversight – Ensuring security, stability, and consumer protection in the financial ecosystem.

- Technological Advancements – AI and machine learning are enhancing fraud detection and transaction speed.

- Evolving Customer Expectations – A growing demand for faster, more reliable, and secure payment solutions.

Ghana’s leadership in digital payments is setting the benchmark for financial innovation in Africa. The country’s commitment to interoperability, security, and efficiency continues to drive greater convenience and accessibility in financial transactions.

With a robust digital payment infrastructure, Ghana is poised to remain at the forefront of financial inclusion and digital banking transformation in Africa.

Click the link Puretvonline.com | WhatsApp Channel to join the whatsapp channel

GOT A STORY?

Contact/WhatsApp: +233243201960 or Email: manuelnkansah33@gmail.com