adverts

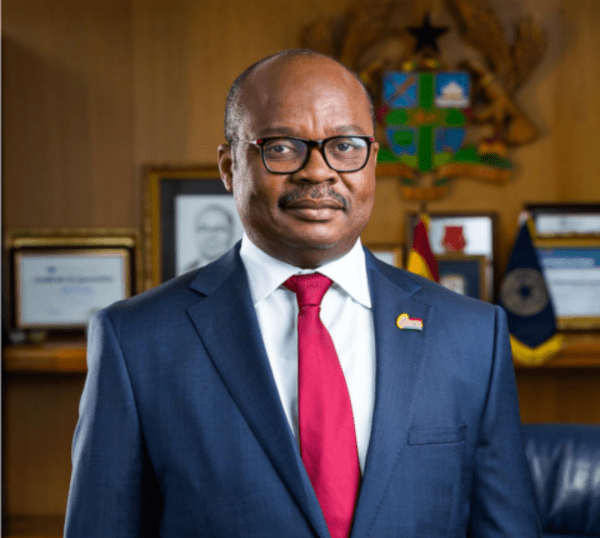

“As long as I remain Governor, none of those licenses will be reinstated”- Dr. Addision swears

The Governor of the Bank of Ghana (BoG), Dr. Ernest Addison, has categorically ruled out the possibility of reinstating any revoked banking licenses during his tenure.

This decision, he asserts, is rooted in extensive reviews that revealed serious lapses in the operations of the affected institutions.

In an interview with Joy Business, Dr. Addison highlighted widespread issues of mismanagement and risky investment practices among the institutions, which he said breached fundamental principles of banking.

adverts

“As long as I remain Governor, none of those licenses will be reinstated,” he declared. “These shareholders treated depositors’ money as their own, using it to fund personal businesses or invest in brick-and-mortar projects that were not liquid enough to make resources available when depositors needed their funds.”

Between 2017 and 2019, the central bank undertook sweeping reforms to stabilise the financial sector. This resulted in the revocation of licenses from nine universal banks, 347 microfinance companies, 39 microcredit companies, 23 savings and loans firms, and eight finance houses. Additionally, some institutions were merged under the Consolidated Bank Ghana (CBG) to ensure continuity of banking services.

The reforms aimed to address severe governance failures, mismanagement of depositor funds, and other irregularities that jeopardised the stability of Ghana’s banking sector.

Despite the central bank’s stance, calls for the restoration of these licenses have persisted. Ahead of the 2024 general election, President John Mahama pledged to reinstate the revoked licenses. He proposed a comprehensive and unbiased assessment as a precursor to stabilising the financial sector and restoring public confidence.

However, Dr. Addison emphasised the weight of responsibility that comes with holding a banking license.

“A banking license is not a casual instrument. It allows you to handle other people’s money, and this responsibility must be taken seriously,” he said.