adverts

In 2024, increasing transaction costs and heightened scrutiny from government authorities, including the Kenya Revenue Authority (KRA), have spurred more merchants in Kenya to embrace cash over mobile payments.

According to Financial Sector Deepening Kenya, cash now accounts for 80% of daily transactions in the country.

Small business owners cite fears that KRA could use mobile money transaction records to enforce higher tax obligations as a major reason for this shift. This trend highlights the growing tension between Kenya’s push for a digital economy and the practical realities merchants face.

adverts

Despite this rise in cash usage, M-Pesa, Safaricom’s flagship mobile money platform, remains a cornerstone of Kenya’s payments ecosystem. Data from the Communications Authority of Kenya (CA) and the Central Bank of Kenya (CBK) show that M-Pesa still holds an impressive 93.4% market share. However, the competition is intensifying.

Pesalink, a real-time payment platform connecting 39 commercial banks, is emerging as a strong contender. With lower transaction fees and seamless interoperability, Pesalink appeals to users seeking alternatives for small transactions.

Meanwhile, Airtel Money, Safaricom’s key competitor, has also made significant inroads, growing its market share from 2.8% to 6.6% in the 12 months leading to June 2024.

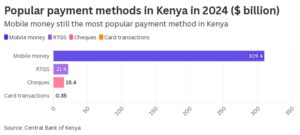

Between January and October 2024, M-Pesa and Airtel Money processed over 25 billion transactions worth more than $309.4 billion. These platforms remain essential for Kenya’s unbanked population, particularly for cash transfers in rural areas, where they also facilitate payments for utilities and other essential services.

Daily transaction limits of up to $3868 make mobile money services ideal for small and medium-sized enterprises handling supplier payments and other business transactions.

While mobile money dominates, traditional payment methods like checks and the Real-Time Gross Settlement (RTGS) system are still significant for larger transactions. From January to October 2024, cheques cleared totalled $15.4 billion, while RTGS transactions reached $21.6 billion.

However, check usage is steadily declining, with a 15.1% drop recorded in June 2024 compared to the same period last year.

Card payments, particularly debit cards, remain a smaller player in Kenya’s payment ecosystem. Total card transactions, including ATM withdrawals and POS payments, amounted to $355.8 million (KES 46 billion) in the first 10 months of 2024, far behind the volume of mobile money transactions. Credit card penetration is particularly low, standing at just 5.6%.

As Kenya grapples with balancing its ambitious digital economy goals and the realities of high transaction costs and tax enforcement, the payment ecosystem remains dynamic.

While cash has gained traction in the short term, mobile money’s convenience, reach, and ability to serve the unbanked population suggest its dominance is far from over. However, competitors like Pesalink and Airtel Money continue to pose significant challenges, signalling a shift in what was once an unassailable market position for M-Pesa.

The evolving landscape underscores the importance of innovation and policy alignment to shape the future of financial inclusion and digital payments in Kenya.