Nigeria’s approval of a 50% telecom tariff increase in January 2025 has unleashed more than $1 billion in new infrastructure spending, breathing fresh life into a sector that had struggled with years of underinvestment.

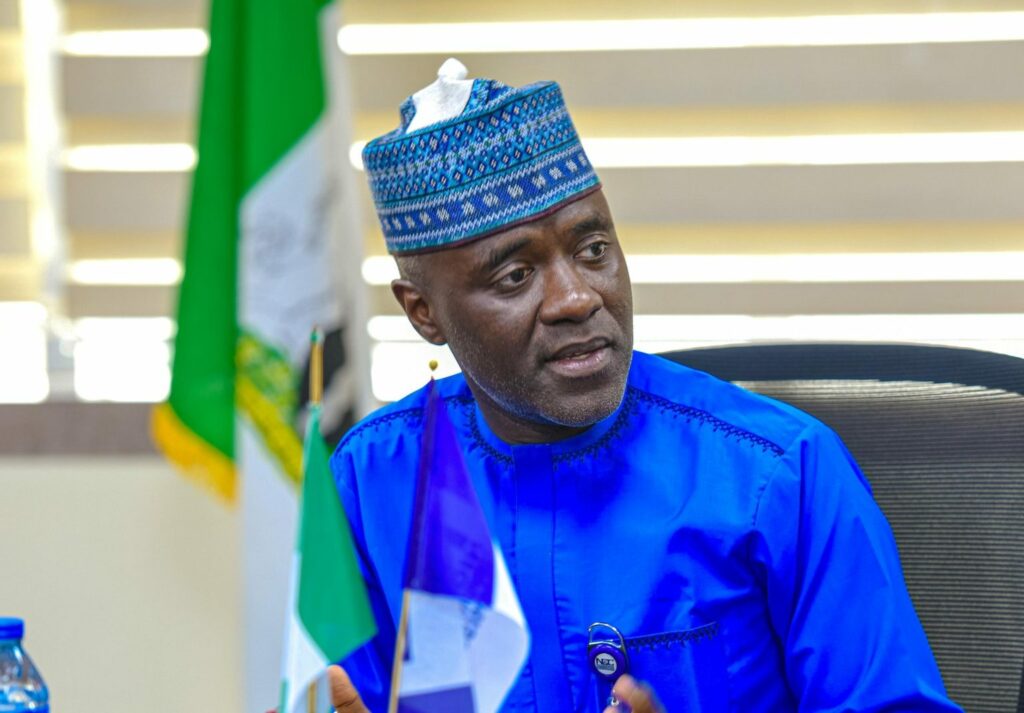

According to Nigerian Communications Commission (NCC) executive vice chairman Aminu Maida, operators including MTN, Airtel, and Globacom are ramping up network upgrades, importing critical equipment, and building new towers.

“The mere act of approving the increase has unlocked investment,” Maida said at a media briefing on August 10. “Cumulatively, this year, we’re already seeing over a billion dollars going into core infrastructure. This wasn’t happening in 2022, 2023, or 2024.”

The NCC defended the tariff adjustment as a necessary return to cost-reflective pricing, comparing it to reforms that spurred Nigeria’s telecom boom in the early 2000s.

“This is a deregulated sector, but over the last decade we drifted back into price control, almost like the old NITEL era,” Maida explained. “Operators were locked into stagnant tariffs while other players across the value chain—tower companies, fibre providers—adjusted their contracts annually for inflation and forex. Investments dried up. By allowing tariffs to rise, we’ve restored balance and unlocked the capital the industry desperately needs.”

The effects are already visible. MTN Nigeria, the country’s largest operator, invested $377.1 million in infrastructure in the first half of 2025 alone—a 288.4% surge year on year. The funds accelerated 4G rollouts, fibre expansion, passive infrastructure upgrades, and the launch of a new Tier 3 data centre.

Airtel Nigeria also boosted commitments, spending $39 million in Q2 2025 on mobile and broadband upgrades. It additionally unveiled a $120 million investment in a 38-megawatt hyperscale data centre at Lagos’ Eko Atlantic, due to open in 2026.

Even smaller players, long dormant, are resuming network expansion. “One of our local operators that had not bought new equipment for three years has started upgrading again,” Maida said.

Nigeria’s telecom market—the largest in Africa—has long been a driver of growth. But between 2020 and 2024, operators faced severe financial pressure.

The government pushed ambitious goals such as 90,000 kilometres of fibre and 7,000 new towers, projects worth more than $2.2 billion, but operators lacked the funds to deliver. Foreign direct investment (FDI) also slowed, dropping to just $134.75 million in 2023 before rebounding to $304 million in the first half of 2024.

Telecoms capex shrank by 30% in 2022 to $523 million, down from $733 million in 2021, underscoring the sector’s funding squeeze.

“The reality is this is an industry that requires continuous investment,” Maida stressed. “Globally, people are already experimenting with 6G while we are still rolling out 5G. No one is going to wait for us. But would you put $1 into a business and accept getting less than $1 in return?”

Turning capital into better service remains a complex task. Equipment must be ordered from abroad, cleared through customs, transported to sites, and installed. Land acquisition disputes also slow new tower construction.

Nigeria’s networks remain heavily dependent on imports, with virtually all core hardware and software sourced from Huawei, ZTE, Nokia, and Ericsson. Diesel fuel—over 40 million litres monthly—still powers much of the network, though the Dangote refinery is expected to ease costs in the future.

For regulators, the tariff hike signals more than short-term relief. Maida emphasised that consistent, market-driven policies are critical to attract long-term foreign capital.

Drawing inspiration from China’s telecom manufacturing rise, he said, “They had a long-term strategy and consistent policy and invested in manpower and manufacturing. Nigeria can get there, but it won’t happen overnight. What we can do now is make sure the investment climate is fair and predictable.”

Infrastructure spending in the first half of 2025 has already exceeded annual levels in previous years, positioning Nigeria’s telecom sector to expand capacity, improve service quality, and prepare for future technologies.

“The bottom line is simple,” Maida concluded. “For service to improve, investment has to happen. And for investment to happen, operators need a fair chance to recover costs. That’s what this tariff adjustment has delivered.”

Click the link Puretvonline.com | WhatsApp Channel to join the WhatsApp channel

GOT A STORY?

Contact/WhatsApp: +233243201960 or manuelnkansah33@gmail.com